Excess inventory: business losses.

Excess inventory: business losses.

Excess Inventory: A Vicious Cycle That Causes Losses for Businesses

Excess inventory is a common problem in Wholesale and Retail businesses. The main cause lies in deficiencies in purchasing planning and replenishment processes.

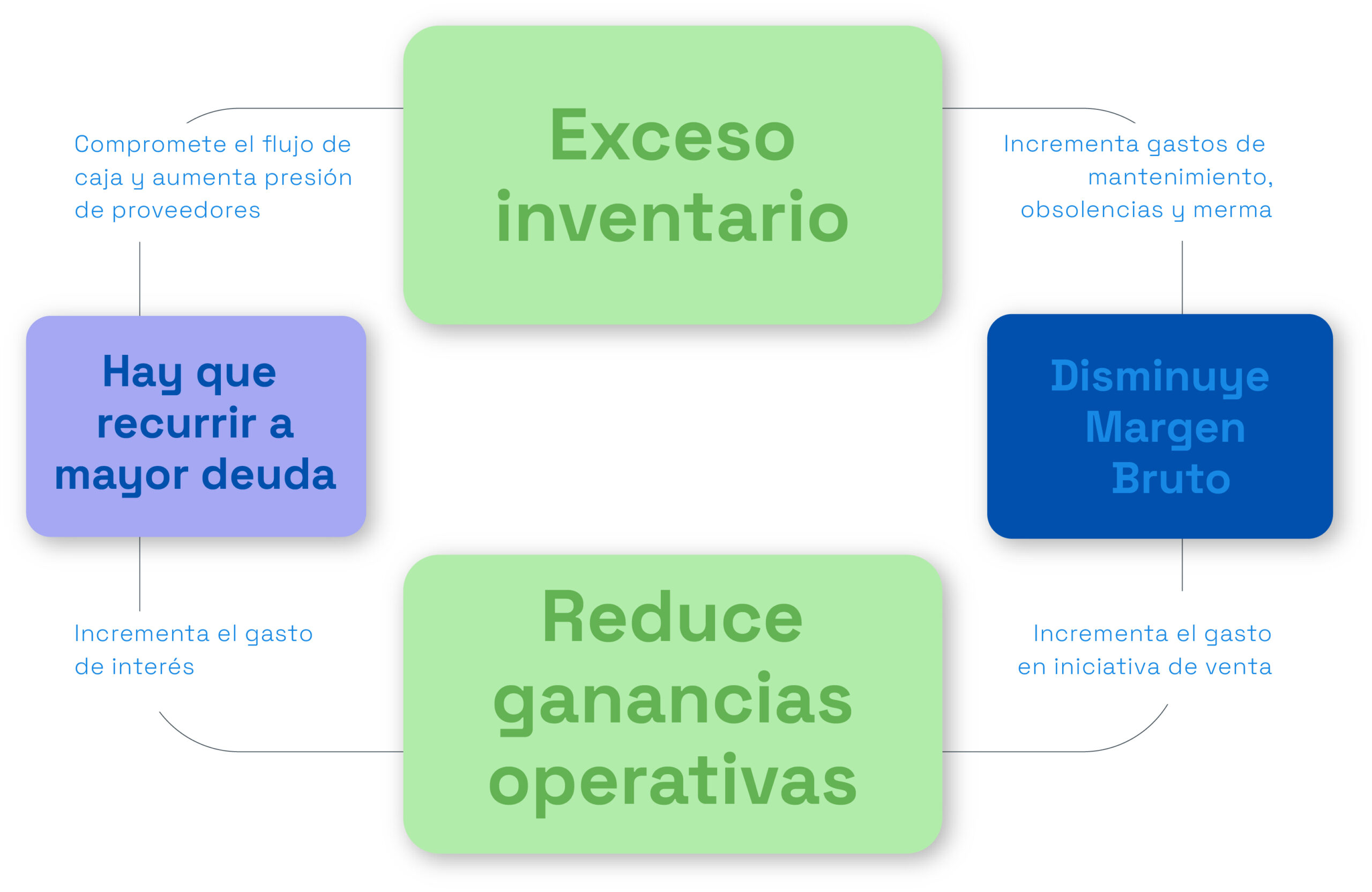

Let’s analyze the vicious cycle of excess inventory:

As described, excess inventory creates problems that severely impact the company’s operating profits and cash flow.

Let’s review the cause-and-effect relationships of excess inventory:

1. Cause: High inventory leads to excessive obsolescence, theft, maintenance costs, insurance, and taxes.

Effect: This results in a lower gross margin. Consider the expenses incurred from purchasing, holding, and selling goods in your business. These can include freight, storage costs, insurance expenses, external or internal theft, obsolescence, spoilage, and taxes.

Studies have shown that the annual additional cost of maintaining excess inventory can range from 25% to 32%. To simplify the calculation, let’s round it to 30%.

2. How else could this ‘excess inventory’ affect your profits?

Cause: A lower gross margin creates pressure to increase sales volume, leading to higher advertising and sales expenses.

Effect: This results in lower operating profits.

When you have more inventory than needed, your profit and loss statement is affected in two ways: a lower gross margin and higher operating expenses. Both reduce your operating profit.

If you have excessive inventory, you will incur additional and likely unplanned advertising and sales expenses to sell the excess stock. These additional costs will reduce your operating profits.

For example, if you spend 4 percent of your sales on advertising costs, of which 25 percent is allocated to clearing excess inventory, the 1 percent saved from your sales volume (25 percent of 4 percent) results in higher profits.

3. Cause: High inventory leads to poor cash flow, thereby increasing pressure from suppliers.»

Effect: This results in excessive debt servicing.

With each sales transaction, cash is generated, driving the system. Cash is used to purchase inventory and pay expenses. When inventory is sold, it becomes cash or accounts receivable, which eventually turns into cash. The faster this cycle turns, the more efficient and convenient the use of your investment will be.

But when your inventory is too high, your excess cash is tied up in inventory—cash that could be used to pay suppliers. When suppliers do not receive timely payments, you will feel the pressure to pay or cancel your supply. As you juggle to keep them satisfied, you will inevitably end up at your banker’s door.

4. Cause: Excessive debt servicing leads to higher interest expenses.

Effect: This results in lower operating profits.

Clearly, the need to borrow to pay your suppliers, instead of generating those funds internally, is costly.

Interest expenses are higher than necessary. When the prime lending rate increases even a quarter of a percent, it raises the interest you pay on that loan related to inventory. So, if you have more inventory than needed, you pay more interest, which increases as the prime rate rises. This higher interest expense is tied to your cash supply, cash that could have been reinvested into new inventory.

As a result, sales are inhibited, and growth is restricted as profits decline.

Effective inventory management requires planning. Don’t just consider sales; also project figures to find the optimal turnover rate for cash flow and profits, as well as for sales. It’s the balance you’re aiming for.

Historically, the evolution of purchasing planning processes was marked by the strong pressure and influence of suppliers, who relied mainly on their sales history to the customer or on filling the spaces of the planograms designed by the customer or agreed upon in contracted spaces with suppliers.

Today, with digital transformation and the introduction of sophisticated and effective platforms like intelligent purchasing software, also known as Computer Generated Order (CGO Nash), which reduces excess inventory and lost sales due to stockouts, increases inventory turnover and GMROI (Gross Margin Return on Investment), and improves inventory investment productivity, the problem caused by excess inventory is solved quickly and effectively by Nash.

Key capabilities of Nash that enable the solution to your purchasing planning and efficient inventory management problems.

• With shorter product life cycles, new competitors, higher financing costs, supply chain uncertainty, and expanding partner and supplier networks, businesses need to detect, process, plan, and respond to changes in real-time.

• Nash’s purchasing and replenishment planning capabilities help you organize the right inventory across your distribution network, minimizing stockouts and maximizing inventory turnover in your supply chain. With Nash, you can achieve a solid return on your invested capital and minimize inventory while maintaining the high service level your customers expect.

Stay Informed

© diciembre 19, 2024 • DEVAICO By ATAsoft. S.A. •