Buffett’s Favorite Companies: Mastering Inventory Optimization.

Buffett’s Favorite Companies: Mastering Inventory Optimization.

Warren Buffett’s Preferred Companies: Optimizing Capital Investment in Inventory Purchases.

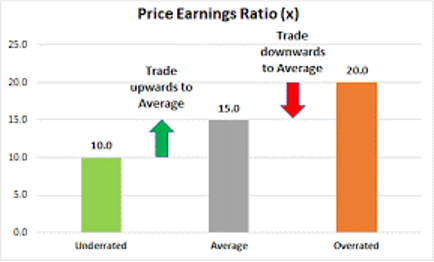

The companies invested in by renowned investor Warren Buffett, CEO of Berkshire Hathaway, must meet basic conditions such as a Price/Earnings (P/E) ratio below 15 and a year-over-year growth in Earnings Per Share (EPS) greater than 7%. Additionally, Buffett considers qualitative factors like the business model’s strength and the management capabilities of the company’s board of directors, among other investment criteria from this investment guru.

Another characteristic that stands out and that we greatly value is that Warren Buffett selects companies that grow their profits with minimal capital investment. In other words, companies that prioritize not only sales growth but, more importantly, the efficiency of the capital used to generate profits.

When evaluating companies in the consultancies we carry out, we often find inefficiencies in capital usage, specifically focusing on analyzing the efficiency of working capital allocated to inventory purchases.

By measuring GMROI (Gross Margin Return on Inventory Investment)—a key inventory productivity metric that reflects the relationship between total sales, the gross margin of those sales, and the monetary value invested in inventory—we frequently observe low levels of this indicator. This negatively impacts the overall ROI of capital, forcing investors or business owners to rely on additional capital or debt to finance growth or sustain the business. Conversely, companies that efficiently utilize this capital enjoy better cash flow and, in many cases, free up resources to return to shareholders through dividends, share buybacks, or new growth investments, rather than locking those resources in slow-moving inventories.

When we implement the Nash intelligent purchasing solution for our clients, one of the outcomes we value most is the improvement in GMROI and inventory turnover. Aligned with Warren Buffett’s philosophy and method of selecting investment opportunities, these companies become the type that reduce their debts, improve cash flows, and grow by optimizing their capital investments.

Display or Planogram vs Demand

One of the major challenges to efficiently use capital invested in inventory lies in filling planograms versus actual product demand. Often in retail businesses, planograms are filled with products that have very slow turnover and extremely low GMROI. While these items may serve as attractive decorations for the store’s fashion merchandising, they are highly inefficient from a capital and physical space utilization perspective.

By understanding the real demand for these products, retailers must adjust their planograms to enhance capital efficiency.

Our experience with hundreds of companies we’ve worked with on these issues demonstrates that this is the best strategy. That’s why it is a central element in the mathematical models and features of the intelligent purchasing and replenishment software, Nash, which we offer to the market and which has delivered excellent results.

In conclusion, an investment guru like Warren Buffett, successful throughout his career and generous in sharing his valuable insights, underscores the importance of capital efficiency in selecting his investments.

We will always strive to work with our clients to maximize the efficiency of their capital invested in inventory by leveraging the most advanced technological tools and the expertise of our team.

Stay Informed

© diciembre 19, 2024 • DEVAICO By ATAsoft. S.A. •